Historic perspective on water and waste

The Netherlands is situated in a vulnerable delta. Ever since the Middle Ages the Dutch had to work together to prevent their homes from flooding. It made them collaborative and innovative. The Netherlands was also early industrialised and polluted. We had to work together again to keep our cities liveable and our economy viable.

The Dutch started seriously with waste management around 1875. We had an initial focus on public health and hygiene. We focused on collection and brought residual waste to public landfills while private collectors took care of flows with some value like metals. Around 1975 we had to move to a focus on environmental protection as landfills where leaking and some incinerators had dioxin emissions. This phase was all about control and technical fixes with for example leachate control for landfills and flue gas cleaning for incinerators.

Later in the 1990’s we moved to a more integrated policy and diversion of waste from landfilling. This was about professionalizing, recycling, solving institutional & responsibility issues, setting up Extended Producer Responsibilities systems, landfill bans & taxes.

Today the Netherlands only landfills 2-3 % of its waste. Yet we realised that working on waste management will not solve our challenges. We realised that we had to look at the full value chain from design to production to usage and the waste phase. We had to embrace a circular economy where waste is eliminated, and resources are kept in the loop as long as possible at their highest possible value.

Unprecedented challenges

The ‘OECD Global Material Resources Outlook to 2060’ projects a doubling of global primary materials use between today and 2060. Recently, COVID-19 stopped the world and has made the dependencies and interconnectedness of supply chains painfully clear. The war between Russia and Ukraine has made us realise even more that providing access to resources should not be taken for granted. The global impact of Climate change and loss of biodiversity will however challenges of a far more impactful nature. We are close to reaching irreversible tipping points and floods, droughts, forest fires, sea level rise and desertification are going to hit us hard and lead amongst other to more migration and resource related tension.

Seawater rise will impact the deltas of the world (and the vast majority of global GDP takes place in delta’s). Doing more of the same cannot be the answer.

Businesses will have to work on resilience in their supply chain and source closer to home to ensure continuity. Trade is likely to become more political caused by geopolitical events and a new more fragmented and less predictable trade landscape will appear. There will be risk spreading and risk reduction by diversification and focus on regionalisation. This near shoring offers opportunities to link global supply chains with regional circular business models,

Circular Economy

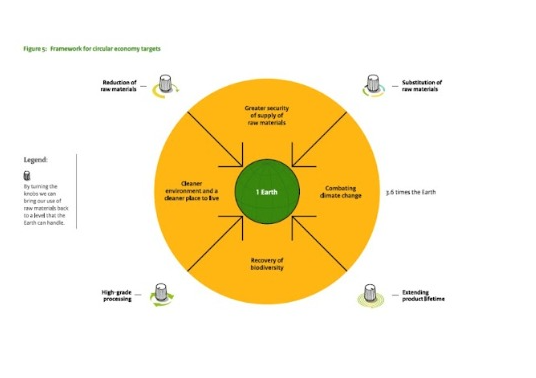

A transition to a Circular Economy (CE) makes so much sense in these circumstances. A CE is often explained to keep resources in circulation much longer and at their highest possible value.

Box: Understanding Circular Economy: The “R” Principles Today, in Europe and beyond the focus is still predominantly on valorisation of materials: Recycle and Recover but in a circular economy that should be the last step. |

For me and many of the CE practitioners, it is not only about keeping materials in the loop but also about renewable energy, preservation of biodiversity, social inclusiveness and new coalitions. It is another way of designing, producing, consuming and dealing with waste. It is a new economic model, a system changes with a fantastic spin-off to sustainability.

Roughly 45% of all Greenhouse Gas Emissions are related to products and not to energy. By going circular roughly 45% of the emissions can be reduced.

Circular Economy is not just about environment, it means working on the Sustainable Development Goals and Climate Goals, not as a cost but as a business model.

it is a no regret scenario for supply chain risks by keeping resources in the loop for our industries and prevent more biodiversity loss by resource extraction. Europe is a resource dependant continent. For example, 100% of the rare earths used in Europe’s batteries are refined in China.

Countries do not have to work for 150 years on waste management like the Netherlands did before they started with circular economy. Waste is dealing with the past, but nothing stops you to keep resources into circulation today by sharing, reusing, repair, refurbishing, remanufacturing and repurposing before we turn to waste management with recycling and recovery. But with design we take the whole lifecycle-cycle into consideration: it is anticipating the future!

The Netherlands: fully circular by 2050

The Dutch ambition, set in 2016, is to become a fully functioning CE by 2050, including a 50% reduction of non-renewable raw materials by 2030. It was an aspirational goal, a moonshot, working with frontrunners and bringing public and private stakeholders together. The Dutch set up 5 transition agendas, focusing on the market segments biomass and food, construction, manufacturing, plastics and consumer goods.

For these market segments four-year plans were developed with goals, milestones and responsible actors. This clear focus allows attracting a critical mass of stakeholders that are needed to scale-up. Furthermore, conditions for change were created by choosing a set of interventions using market instruments, providing access to financing, stimulating innovation, tackling the behaviour component and international collaboration. Global collaboration is essential. It makes no sense to create a circular island of the Netherlands if the rest of the world does not follow. My organisation, Holland Circular Hotspot, is pivotal in the last item.

In the new Dutch National Circular Economy Action Plan (2023-2030), we shift from a voluntary, non-committal approach to a more target-oriented and mandatory approach consisting of a mix of pricing, standard-setting and stimulus measures.

We will be setting targets for specific product-market groups. It is not enough to talk about plastic in generals, you must address plastics in packaging, plastics in agriculture or in construction if you want stakeholders to follow-up with actions. Policy actions will be announced and pricing, supporting and standard setting measures will be taken. Product market group will be partly linked to climate goals.

Some supportive actions are transversal to product market groups. Thinlk of measures like metrices and monitoring CE, measures related to financial instruments and public procurement or measures related to behaviour and education.

How are we doing? The Netherlands is according to the Circularity Gap Report 2020 24,5% circular (that means that we are for 75,5% not circular yet). The CGR score of the world is only 7,2% (2023). We have a long way to go.

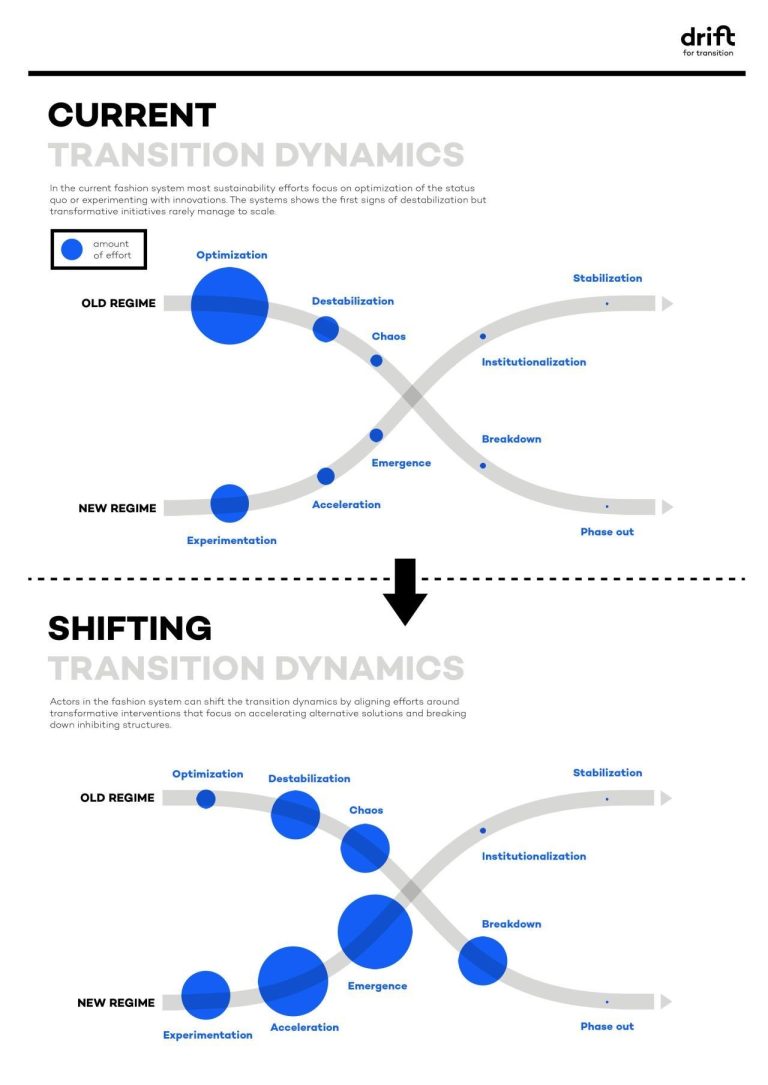

Circular Economy is about building up a new regime and phasing out an old regime in parallel

While working on new initiatives, through experimentation, acceleration and emergence and scaling up of new viable business models we have at the same time to transition the old linear economy, an economy that for example does not price in externalities or has subsidies that direct in the wrong way and usings harmfull substances that prevent multiple life spans.

Lessons learnt from The Netherlands about the roles of 4 key stakeholder group

To make the transition to a complete circular economy, actions are required from all stakeholders and new cross-sectoral partnerships are inevitable. No actor can reach a CE alone.

- Government sets the ambition, conditions and allow experimentation. They connect networks to collaborate in ecosystems, support innovations getting to the market, challenge industry to perform and improve their impact and regulate to create ambitious framework. Cities and regions are the place of action, it is the place where people work, live, recreate. In the Netherlands a lot of Cities or Harbour regions, like the Ports of Rotterdam, Amsterdam or Groningen Seaport, have mapped the potential for circular development in their region and have set-up a roadmap for action.

- Knowledge institutes develop new insights, enable valorisation of their knowledge and create awareness. Awareness and collaboration is key: the transition towards a CE is probably 75% about social innovation.

- Involvement of citizens/consumers is crucial. To involve the young generation, the leaders and consumers of tomorrow, it is important to introduce and mainstream circular thinking into all education and trainings.

- Entrepreneurs show guts, take risks, invest, accelerate and are the main actors of a scale-up.

The crucial role of businesses

The first circular movers in the Netherlands were forward looking multinationals and start-ups.

Former DSM CEO Feike Sijbesma said “we cannot be successful or call ourselves successful in a society that fails”. As a multinational you know that R&D can take at least 2 years, permitting and building a new plant can take another 2-3 years. A plant is likely to be in operation for the next 20 to 30 years. You don’t have to be a rocket scientist to know that in 20 years we will live in a society where the societal acceptance for pollution and injustice will be quite different. It is about your future licence to operate. Pollution, including CO2 will have a price. This is about your future markets. You have to anticipate today, and first movers will most likely have the biggest market advantage.

Like in every country there is also a new, well-educated, connected and impatient generation with fresh ideas on how we can do thing different and better for us and the planet. They created an unstoppable circular bottom-up movement around local and scale-able solutions.

How does a transition start? Companies often start small with waste and resource management actions. Pretty quickly you will realise that just working in your own back garden there are limits to optimisation. You will have to work upstream and downstream in your value-chain to make a real impact. If your supplier would for example redesign his product you might be able to do much more. It is about circular value chains and circular ecosystems. But if you focus on resource optimization only you will soon find out that there are circular and digital models from start-ups on the market that are disrupting your market. For example: music CDs dematerialised into digital services.

You have to keep moving towards new circular business models with for example circular supplies, sharing platform models, products as a service, product life extension or resource recovery.

For businesses it makes sense to go circular.

- Think how markets have grown with sharing, service or platform models

- Imagine the additional value created from resources by lifetime extension for example giving your phone a second a third or a fourth life.

- Isn’t saving resources, energy or water in production not directly lowing your costs?

- CE is collaborative: by working intensively together and mutual dependency in a chain you also reduce risks.

This involvement of entrepreneurs is crucial as they (big and small) are the main actors of a transition to a Circular Economy.

SMEs are key drivers of green innovation; they are faster and more manoeuvrable than big corporates. However, SMEs face challenges linked to lack of adequate policies and finances. They lack knowledge and capabilities and find it more difficult to raise capital for circular endeavours compared to larger corporates. These are challenges that we need to address.

For cities it is important to involve businesses from the start and give room for experimentation. They can facilitate interdisciplinary and cross-sectoral collaborations by organizing workshops and giving a platform to frontrunners and showcase best practices in their city. By circular procurement they can also lead by example. Public procurement is typically 15 to 20% of GDP.

Innovations frequently come from outside your own sector. A sector like agrifood is connected to energy, water, healthcare and packaging. Everybody has a role to play and cross-sectoral collaboration is key!

The European context

When it comes to a green transition the EU is in the lead. It acts as a lighthouse and guardian for the greater good for its Member States that face shifting political realities that make it difficult to be bolder in the field of sustainability.

The EU is balancing Climate Change Response and Economic Opportunity. Europa want to be Climate Neutral by 2050, transforming our economy and societies. Climate change is the biggest challenge of our times, and the EU sees it, just like the Dutch, as an opportunity to build a new economic mode. It includes many sub targets.

- Making Transport sustainable for all

- Leading the green industrial revolution

- Cleaning our energy system

- Renovating buildings for greener lifestyles

- Working with nature to protect our planet and health

- Boosting global climate action

If we analyse the Green deal in detail with all its specific Strategies, Policies, Regulations, Directives and Acts in the field of Energy, Transportation, Climate & emissions, Land & Animals, Water, Chemicals & pollutants, Waste, Products & materials, Consumer goods, Reporting and Funding & Support it is not hard to conclude that it will become a regulatory reality for every company in the EU and every company outside the EU that wants to trade with the EU.

A deep dive by sector with some practical examples

Priority Sector Construction

If we do not make the built environment more sustainable, we cannot reach the climate goals. The building sector account for half of extracted material use, 38% of greenhouse gas emissions and one third of waste generation in Europe.

With an urgent need for 1 million new homes by 2030, the Netherlands is in a significant housing demand. Residential construction is thus one of the top focus areas in the Netherlands. Dutch policies strongly promote the use of biobased and recycled materials and sustainable building practices, creating opportunities for collaboration in the construction sector. Also, intensive industrialization from construction site to factories are part of the transition

The Netherlands has adopted innovative strategies to meet its housing goals, including repurposing public spaces for residential use, constructing smaller and more efficient homes, emphasizing material reuse and recycling, and prioritizing biobased building methods. For example, Amsterdam aims to develop new homes primarily from wood, despite the country’s limited domestic wood resources. Additionally, the urgent demand for housing has led to the adoption of modular, lightweight, and easy-to-assemble temporary housing solutions.

More broadly, the Netherlands’ urban redevelopment projects, which prioritize sustainable and low-impact designs, present a significant market for these innovations. To support this transition, material passports—detailed records of the materials used in construction to facilitate reuse and recycling— are expected to become mandatory. Moreover, platforms linking offer and demand of (secondary) materials are being actively promoted.

Insights:

- Circular biobased roads: Circuroad developed lignin-based asphalt, a sustainable alternative to bitumen.

- Modular biobased homes: Tala constructed homes from cross-laminated timber (CLT), wood fibre insulation, and bamboo-pine facades, achieving 90% biobased content by volume and incorporated frames crafted from fully recycled plastic.

- A material passport records the characteristics and value of building materials for reuse and recycling. It tracks products in buildings, supporting refurbishment or reuse when deconstructed, and turning buildings into material banks. Madaster is a platform which facilitates the central standardized, web-based registration of materials and products applied in the built environment. The platform automatically calculates environmental impact including embodied carbon, detachability and circularity using specific and generic data sets including EPD and circular data. It also provides a financial valuation of registered objects (current and future expected residual value of materials) and includes a product proposition that facilitates product passports for manufacturers.

Priority Sector Agrifood & Biomass

If we turn our gaze to the world to agrifood we still have a mighty challenge ahead.

To feed the world in 2050 56% more food is needed, without using more land and this needs to be nutritious, affordable, reducing GHGs and increasing biodiversity and soil health.

The Netherlands is a major hub for food production and processing, with a strong emphasis on reducing food waste, sustainable and efficient food production and new technology developments in food production. The market is mature for vegan diets.

Insights:

- Proteins for animal feed: Proteins from meat have a tremendous environmental impact. Protix is an example of alternative proteins derived from the larvae of black solderflies that can be used to produce aquaculture and animal feed, food and pharmaceuticals.

- Vegan products: The Vegetarian Butcher offers soy-based plant proteins to cater to the growing vegan market.

- When you see an orange peel, what do you see? Do you see organic waste (at a cost) or can you also imagine seeing potential new applications like biofuel, food, perfume or breathable fabric? By the way: this exactly what Dutch start-up Peel Pioneers did!

Priority Sector: Plastics

The Dutch government has strict regulations and targets for reducing plastic waste, especially single-use plastics. SMEs that provide alternative materials, biodegradable options, or advanced (mechanical and chemical) recycling technologies can benefit from demand in this sector. Circular solutions in packaging and waste-to-resource innovations are especially relevant, as the Netherlands is moving steadily towards eliminating plastic waste from its supply chains.

Insights:

- Protective coatings for food: Liquidseal creates plastic-free protection for perishables such as avocado, citrus, mango, and papaya, edibale coatings for cucumbers and protection for flowers.

- Chemical Recycling technologies are rapidly developing and helping not only a waste problem but also accelerate the pathway towards a Climate Neutral Chemical Industry in 2050. CuRe discovered a smart low energy and scalable solution to create a fully circular polyester chain.

Priority Sector: Consumer Goods

The Netherlands has a growing market for sustainable consumer goods, driven by eco-conscious consumers and supportive policies. Companies with circular business models, such as product-as-a-service, repair, and resale models, or products made from recycled materials, and advanced sustainable technologies, can establish a presence in the Dutch retail landscape. A lot of momentum is visible in textiles for which EPR has been introduces and for electronics, especially linked to Europe’s need for resource resilience for a number of Critical Raw Materials.

Insights:

- Take back circular shoes system: Emma produces circular safety shoes designed for re-use, with a reverse logistics system to take back valuable materials.

Eco-firendly textile dying: Dyecoo developed water and chemical free textile dyeing using CO2 in a closed-loop system.

- Lena Fashion Library offers always something new without having to buy it

- Closing the Loop offers a pragmatic, hands-on approach to reduce the complex, worldwide e-waste problem. One device collected for one device sold. The solution enables the Central Government to take important steps in awareness and urgency within the entire country.

- CooLoo develops and produces products and finishings for interiors, furniture, acoustic solutions, and industrial applications based on innovative coating technologies and the use of recycled materials.

Priority sector: Circular Manufacturing

The Dutch manufacturing sector, especially in capital equipment, is transitioning towards circular production models, focusing on reducing waste, extending product life cycles, and using recycled materials. This shift opens avenues for companies that provide circular design, sustainable manufacturing technologies, and energy-efficient solutions.

Insight:

- Circular and fair phone: Fairphone creates modular, repairable phones from ethically sourced materials

- Modular furtniture: Ahrend produces modular office furniture designed for easy repair and upgrades.

- Lely manufactures and remanufactures milking robots. Remanufacturing extends the lifetime of 10-14 years with an additional 5-7 years. To create access to second-hand market Lely launched an open trader platform in 2020. Currently about 10% of their robots sold are pre-owned.

- ASML gives the world’s leading chipmakers the power to mass produce patterns on silicon. Thanks to their modular design ASML is able to upgrade their systems while they are in use ‘in the field’. Older systems are refurbished to produce comparatively less sophisticated chips. With the effect that almost every system sold since 1991 is still in use.

- Philips Healthcare spearheads the transition to a more circular healthcare industry. Philips is working to embed the principles of the circular economy into everything the company does and is developing new business models to support this, such as product-as-a-service, take-back schemes, and upgrade and refurbishment programmes. In 2022, 18% of Philips business revenue came from circular products and services; and the company already offers trade-ins on all large medical equipment.

Red thread among Dutch best practices

A collaborative approach and a multi-stakeholder eco-system innovation characterizes the Dutch approach.

Food Valley, a Food eco-system in The Netherlands, is a practical example of how innovation starts in practice. Their large mukltistakeholder network allows thematic communities to form (for examples around alternative proteins or around upcycling of residues). It is within these communities that specific initiatives are ignited and grown into viable businesses later scaled to new sustainable sectors.

What caracterises the Dutch in all these market segments is not only a collaborative approach but also a certain pragmatism: Learning by doing, don’t wait for a perfect world. Learn fast and fail fast: you either win or you learn, you never loose.

In all this my organisation Holland Circular Hotspot (HCH) is a highly effective and extremely well networked not-for-profit organisation, dedicated to advancing the Dutch circular economy on an international scale. HCH works closely with the Dutch representative network and its unique Circular Hub network in building connections and sharing expertise. In India we collaborate with the Intrenational Council for Circular Economy (ICCE. HCH actively supports Dutch businesses and their foreign counterparts in adopting innovative, circular practices. Indian companies can benefit greatly from this network, which provides critical access to partnerships, valuable market insights, and strategic guidance. HCH offers a wealth of knowledge on circular economy, eco-system transitions and the regulatory frameworks within the Dutch and the European market.

India

India has become the fifth largest economy in the world (2022) and India has targets for 2070: becoming Net-Zero by scaling up its non-fossil energy capacity, reducing carbon emissions and the carbon intensity of its economy. Circular Economy can reduce up to 44% of India’s GHG emissions in 2050, and according to Morlet, et al. (2016), a circular economy path could bring benefits to India of around US$ 624 billion, ~ 30% of India’s current GDP.

There are plenty of options for a win-win collaboration. All Circular business models could work in India: circular supply chain, recovery and recycling, product lifetime extension, sharing models and Product as a service.

India, the Netherlands and Europe share resource resilience challenges related to critical raw materials. The Fashion Industry will step in the footsteps of the plastics industry as it comes to awareness that business as usual is no longer an option. The Netherlands, a CE leader and an agrifood & biomass innovation power, could very well collaborate with India on addressing the various food challenges and value-opportunities towards 2050. Furthermore, Dutch innovations might boost the waste and construction sector, an area with key developments towards the future.

For most of the Dutch best practices mentioned similar Indian examples can be found. However, all these innovations still need to scale. By working together and by tweaking technology and working on eco-system innovation we can be a catalyst for a sustainable and more circular future. It is not about copyright but about the right to copy.

CEO of Holland Circular Hotspot (HCH)

Co-chair of the coordination group of the European Circular Economy Stakeholder Platform (ECESP).